Gulf stock markets rallied on June 24, 2025, driven by renewed investor confidence following a US-brokered ceasefire between Iran and Israel, which ended a 12-day conflict.

The announcement, made by US President Donald Trump, alleviated concerns over potential disruptions in the Middle East, a critical hub for global oil supply, leading to sharp declines in oil and gold prices as risk appetite shifted toward equities.

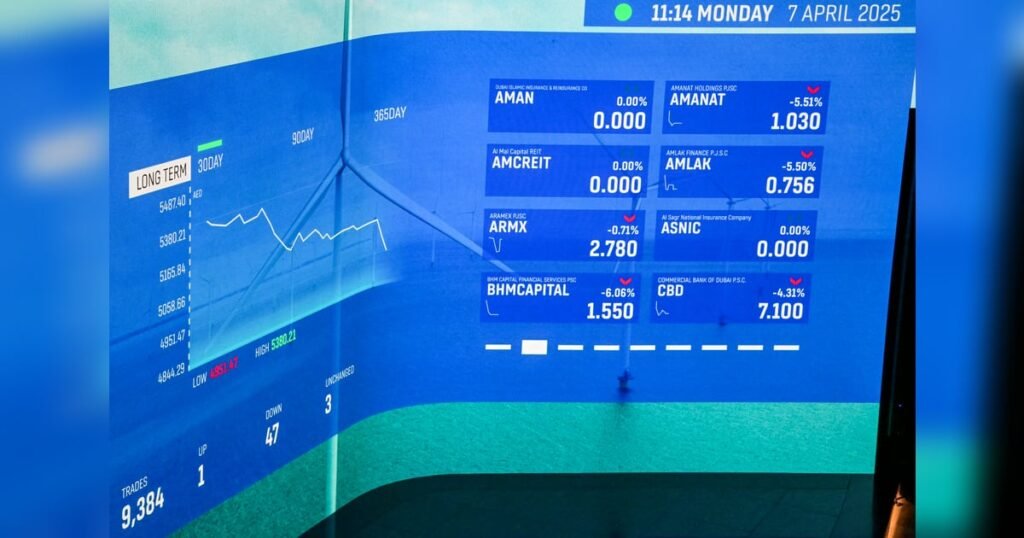

Abu Dhabi’s benchmark index climbed 2.5 per cent, with Aldar Properties leaping 8.7 per cent, bolstered by expectations of stabilized economic conditions.

Saudi Arabia’s Tadawul index advanced 2.3 per cent, driven by gains in financial heavyweights. Al Rajhi Bank rose 2.0 per cent, while Saudi National Bank gained 2.4 per cent. Budget carrier Flynas, recently listed, skyrocketed 7.5 per cent to 80.20 riyals, capitalizing on the positive market sentiment. However, Saudi Aramco bucked the trend, declining 1.5 per cent amid falling oil prices, and SABIC Agri-Nutrients slipped 1.2 per cent.

Qatar’s benchmark index rose 2.1 per cent, supported by a 2.3 per cent increase in Qatar Islamic Bank. The rally followed Qatar’s civil aviation authority reopening its airspace after a brief suspension prompted by an Iranian missile strike on a US air base in Qatar on June 23, 2025, which caused no casualties. The swift restoration of air operations signaled a return to stability, boosting investor confidence.

Oil prices plummeted as the ceasefire reduced fears of supply disruptions. Brent crude futures fell 4.8 per cent to $68.12 a barrel by 0645 GMT, hitting a two-week low. The drop followed a peak of $81 per barrel during the conflict, which had stoked concerns over rising fuel costs impacting global inflation.

Priyanka Sachdeva, senior market analyst at Phillip Nova, said: “If the ceasefire holds, oil prices could stabilise, but adherence by both parties will be critical.” However, prices edged up slightly later in the day after Israel accused Iran of violating the ceasefire with a missile strike, highlighting lingering uncertainties.

Gold, a traditional safe-haven asset, also faced downward pressure as investors pivoted to riskier assets. Spot gold dropped 1.5 per cent to $3,315.20 an ounce, its lowest since June 10, 2025, while US gold futures fell 1.8 per cent to $3,330.80. The decline pushed gold below its 20-day simple moving average, a key technical indicator, with the Relative Strength Index dipping below 50 for the first time since mid-May 2025, when prices corrected to $3,120.

Daniela Sabin Hathorn, senior market analyst at Capital.com, observed, “While the pullback is controlled, $3,330 is a critical support level. A break below could signal a deeper correction.” Despite the dip, long-term fundamentals, including geopolitical uncertainty and inflation concerns, continue to underpin gold’s appeal.

Global markets echoed the Gulf’s optimism. In Europe, the UK’s FTSE 100 rose 0.5 per cent, France’s CAC-40 gained 1.5 per cent, and Germany’s DAX advanced 2.2 per cent. In Asia, Japan’s Nikkei closed 1.2 per cent higher, and Hong Kong’s Hang Seng surged 2.3 per cent, reflecting widespread relief over de-escalation.

Ilya Spivak, head of global macro at Tastylive, said: “The ceasefire has significantly reduced near-term geopolitical risk, driving a shift from safe-haven assets to equities.”

Investors are now focused on upcoming testimony from Federal Reserve Chair Jerome Powell before the House Financial Services Committee. Powell has remained cautious about signaling imminent rate cuts, despite Trump’s call for a 2–3 percentage point reduction in US interest rates. Lower rates could further boost equities but may pressure gold further by reducing its appeal as a non-yielding asset.

While the ceasefire has sparked a rally in Gulf markets and global equities, the fragility of the agreement remains a concern. Israel’s claims of Iranian violations underscore the potential for renewed tensions, which could reverse gains and reignite demand for safe-haven assets like gold and stabilise oil prices. For now, Gulf markets are riding a wave of optimism, but investors remain vigilant, balancing hope for stability with the region’s complex geopolitical realities, says analysts.