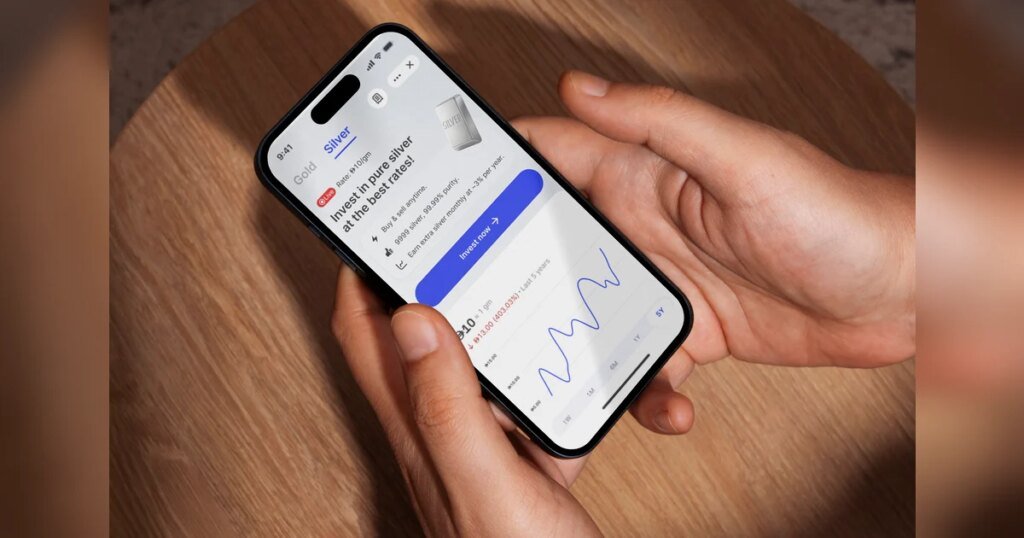

Botim Money has expanded its investment offerings in the UAE by launching digital silver trading on its platform, allowing users to invest in the precious metal with as little as Dh10 and further broadening access to alternative assets for retail investors.

The new feature enables eligible users to buy, sell and manage fractional silver holdings directly through the botim app, marking the latest step in the fintech platform’s push to democratise investing and strengthen its digital wealth ecosystem. The move follows the successful rollout of in-app gold investment services introduced in partnership with OGold in 2025.

By lowering the traditional barriers associated with physical precious metals — such as high minimum purchase values, storage and handling — Botim Money aims to make silver investment more accessible to everyday users. Investors can now gain exposure to silver prices through a regulated digital interface without needing to buy and store the metal physically.

The launch is significant for investors because it offers a low-cost entry point into precious metals, traditionally viewed as a hedge against inflation and market volatility. With fractional investing starting from Dh10, retail investors can diversify portfolios with minimal capital, making wealth-building tools more accessible to younger and first-time investors.

The expansion builds on strong demand for digital gold investment on the platform. Since its launch in August 2025, Botim Money’s gold feature has recorded more than 128,000 in-app trades with a total transaction value exceeding Dh100 million. The rapid adoption underscores growing appetite among UAE-based users for simple, app-based investment solutions that allow them to diversify beyond traditional savings products.

Sacha Haider, chief operating officer of Astra Tech and botim, said fractional investing has helped remove traditional minimum investment thresholds that historically limited participation in precious metals markets. Extending the same model to silver, combined with botim’s wide user base and ease of use, creates a seamless pathway for users to begin investing and diversifying their portfolios.

The initiative also strengthens botim’s strategic partnership with OGold, an Emirati precious metals platform focused on digitising gold and silver ownership.

Bandar Alothman, chairman and founder of OGold, said the collaboration aims to make precious metal ownership simple, secure and accessible to millions of users while allowing digital silver holdings to generate returns through structured investment solutions rather than remaining idle.

The timing of the launch comes as silver gains renewed global attention both as a store-of-value asset and as a critical industrial metal used in renewable energy, electronics and manufacturing. Industry forecasts indicate the global silver market could record a sixth consecutive annual supply deficit in 2026, with a projected shortfall of around 67 million ounces. At the same time, retail investment demand for silver is expected to rise despite softer industrial demand in some segments.

For investors in the UAE, the addition of digital silver provides a new avenue for portfolio diversification alongside gold and other asset classes. It also reflects a broader shift towards digital-first financial services in the country, where fintech platforms are increasingly offering accessible investment tools within everyday payment and remittance apps.