Global trade executives are entering 2026 with strong confidence that resilient supply chains, alternative shipping routes, and accelerating infrastructure investment will continue to drive commerce expansion, even as tariffs, geopolitical tensions, and policy uncertainty persist, according to a new survey by DP World released at the World Economic Forum in Davos.

DP World’s Global Trade Observatory Annual Outlook shows 94 per cent of senior supply chain and logistics executives expect trade growth in 2026 to match or exceed the pace of 2025. More than half of respondents — 54 per cent — forecast faster expansion, while 40 per cent expect growth to hold steady.

The survey covered 3,500 executives across eight industries and 19 countries.

The upbeat sentiment stands in contrast to cautious projections from international institutions. The International Monetary Fund expects global merchandise trade volumes to expand by about 2.3 per cent in 2026, down from an estimated 3.6 per cent in 2025, citing softer demand, elevated financing costs and persistent geopolitical risks.

The World Trade Organisation has also warned that fragmentation, subsidy competition and industrial policy interventions could weigh on trade flows, even as digitally delivered services and cross-border e-commerce continue to expand faster than traditional goods trade.

Despite these headwinds, executives appear increasingly confident in their ability to operate in a volatile environment. About 53 per cent of survey participants expect high or very high policy uncertainty in 2026, while 90 per cent anticipate trade barriers to rise or remain unchanged. Yet only 25 per cent expect a negative impact on their business. Nearly half foresee no meaningful effect, while 26 per cent even expect trade restrictions to create new commercial opportunities through rerouted cargo flows, regional logistics hubs and alternative sourcing networks.

Sultan Ahmed bin Sulayem, group chairman and chief executive officer of DP World, said the operating environment has become structurally more complex rather than cyclical. “Global trade is becoming increasingly complex, not less so. Our role is clear: to keep trade moving by understanding where friction exists, anticipating where it may emerge next, and investing in the infrastructure, capabilities and partnerships that help our customers operate more efficiently and reliably,” he said.

Executives identified Europe as the top region for trade growth potential in 2026, cited by 22 per cent of respondents, followed by China at 17 per cent. Asia Pacific accounted for 14 per cent, while North America represented 13 per cent. The outlook reflects expectations of stabilising European demand, China’s export rebound driven by electric vehicles, renewable energy equipment and industrial machinery, and the continued expansion of intra-Asian supply chains.

The UAE is emerging as one of the fastest-growing trade hubs, benefiting from these shifts. The World Trade Organization projects the Middle East to outperform global merchandise trade growth in 2026, supported by logistics investment and diversification strategies. The UAE government data shows the country’s non-oil foreign trade exceeded Dh4.3 trillion in 2024, rising more than 14 per cent year on year. The Ministry of Economy expects trade volumes to continue expanding in 2026, driven by comprehensive economic partnership agreements with more than 20 countries, deeper integration with Asian and African markets, and the expansion of port and free-zone capacity in Dubai and Abu Dhabi.

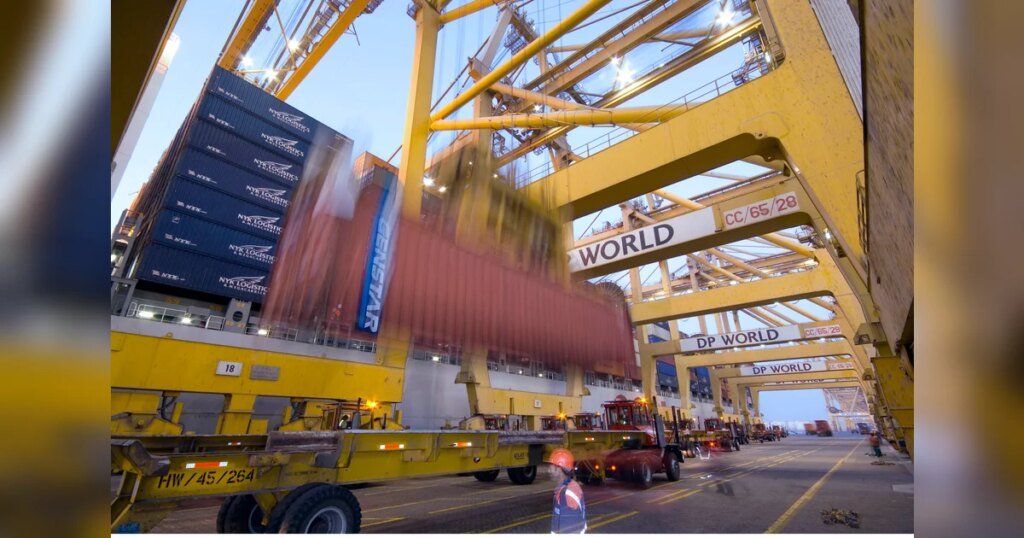

DP World has reported rising throughput across Jebel Ali and its regional terminals, reinforcing the UAE’s growing role as a transshipment and re-export hub linking Asia, Europe and Africa.

Companies are also reshaping supply chains at an accelerating pace. The survey shows 51 per cent of firms plan to diversify suppliers this year, 44 per cent intend to increase inventory buffers, and 36 per cent are adopting friend-shoring strategies that prioritise politically aligned markets.

UNCTAD estimates that more than $1.3 trillion in manufacturing investment has been announced globally since 2022 under supply chain reconfiguration programmes, highlighting the scale of the structural realignment underway.

Route flexibility is becoming a central element of trade strategy. About 26 per cent of respondents plan to adopt new shipping routes in 2026, while another 23 per cent are actively evaluating alternatives. Decisions are being driven by cost savings, improved inland connectivity and faster customs clearance. The expansion of Asia-Europe overland corridors, Middle East logistics hubs and Africa-linked maritime routes reflects a broader push to reduce dependency on traditional maritime chokepoints.

Border friction remains a persistent constraint. Around 60 per cent of executives cited customs clearance as a leading cause of delays and disruption. Respondents prioritised investment in warehousing and logistics hubs, road networks and border processing infrastructure as critical to improving trade efficiency.

World Bank research shows that cutting border processing time by just one day can lift trade volumes by up to 1 per cent, reinforcing the economic case for digital customs platforms and integrated clearance systems.